Those states include California, New York, and Hawaii, among others. In addition to unemployment taxes, some states will also require disability insurance deductions from employers. The specific amount varies from state to state. Unemployment Taxes: According to the Federal Unemployment Tax Act employers are required to contribute a percentage of their taxable income towards unemployment insurance. All employers and employees are required to deduct 6.2% of their wages for Social Security (up to a maximum of $110,100), and 1.45% of their wages for Medicare. Social Security and Medicare taxes: After income tax withholding, Social Security and Medicare taxes tend to be the largest deductions from a paycheck.

#Quickbooks payroll tutorial 2017 paying taxes free

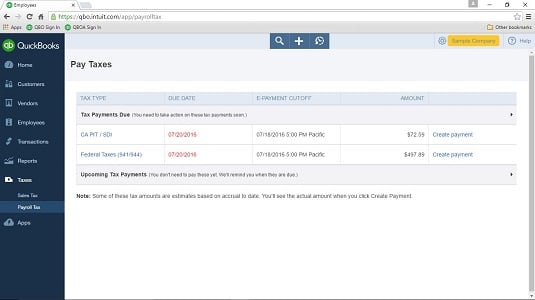

If you need payroll software, Intuit Enhanced Payroll is exactly what you need. Intuit also offers a 30 day free trial and its only $2/ per additional employee. Contrary to what some people believe, income tax withholding payments aren’t technically viewed as final income tax payments instead, they’re simply viewed as prepayments. Employers are required to withhold tax from each paycheck paid to an employee in that particular jurisdiction. Income tax withholding: Income tax withholdings are assigned by the federal, state, and local governments. In the United States, payroll taxes are imposed on all employers and employees. Most of the world’s developed countries have federal and state-level systems designed to assess and collect payroll taxes. Both employers and employees are required to pay their portion of these taxes.

Other employer taxes, which are required from all employers in order to cover federal programs like Social Security and unemployment insurance.These are also known as Pay-As-You-Earn (PAYE) taxes. Withholding taxes, which are taxes employers are required to withhold from the wages of every employee.Payroll taxes consist of two types of taxes employers are required to pay: I’ll show you the best ways for a business to manage its payroll taxes, reduce errors, and increase bookkeeping efficiency. Today, I’m going to explain the intricacies of payroll tax. If you want to legally employ people, you’re going to need to pay payroll tax. Payroll tax is an unavoidable part of running a business in the United States.

0 kommentar(er)

0 kommentar(er)